Recently, the first domestic and second-generation LCD panel line in the world, along with the Great Wall Computer’s announcement, revealed that the company was jointly funded by a subsidiary of the Chinese Electronic Information Industry Group (CEC) such as China National Electric Panda Co., Ltd. and was established in Nanjing. The 10th generation TFT-LCD production line will enable China to become the second country after Japan to have the top TFT-LCD production line (10th generation line), together with two 8.5 generation production lines of BOE and Huaxing Optoelectronics, accounting for the flat panel display industry in China. The world is very important.

The competitiveness of the mainland has significantly improved the rapid rise of China's panel industry, making the transition of the flat panel display industry to mainland China an inevitable trend.

The launch of the 10th generation LCD panel production line of the Chinese panda will greatly enhance the status of the flat panel display industry in mainland China. In 2011, with the production of high-end panel production lines such as BOE, China Star Optoelectronics, and China National Electric Panda, the domestically produced large-size panels had a qualitative breakthrough, but the global market share of domestically-made panels did not exceed 3%, while South Korea rose to approximately 53%. With the mass production of high-generation line in mainland China, the global market share of domestic panel is expected to exceed 20% in 2012. If the next 10th-generation line can be successfully completed, the Chinese mainland will grasp the new pattern of the flat panel display industry. Foreign companies have reduced the investment in LCD panel production lines, and the rapid rise of China's flat panel display industry has made the transition of the flat panel display industry to mainland China an inevitable trend. Just as in the 1980s, Xianyang Rainbow, Beijing Panasonic, and Shanghai Yongxin played a role in the development of China's color picture tube industry.

In addition, China's investment in 10 generation LCD panel lines will significantly increase the competitiveness of domestic LCD monitors. Domestic notebook computers, microcomputers, and color TVs have always maintained rapid growth. In 2011, China’s output of color TVs exceeded 120 million units, of which the output of LCD TVs exceeded 100 million units. At present, in the panel supply of major domestic branded LCD TVs, domestically produced panels accounted for only 6.8%, and Korea’s two major panel makers accounted for approximately 43.5%. LCD panels account for 2/3 of the total cost of LCD TVs, and domestic color TV manufacturers are forced to spend huge sums of money to import key components such as LCD panels. In 2010, for example, China imported more than 46 billion U.S. dollars worth of LCD panels, second only to integrated circuits, oil, and iron ore. In 2011, China's color TVs used liquid crystal panels to achieve everything from scratch, and completely ended the history of large-size LCD screens completely dependent on imports. If the 10th generation line is completed, it will provide 60-inch panels for domestic TV sets, which will further reduce the cost of domestic TV sets and increase market competitiveness.

Occupy a new height in the vertical integration of the industrial chain. The completion of the investment of the two panel production lines by the Panda in China will enable the industrial chain to be completely opened up, and TPV will also obtain a stable panel supply.

Vertical integration of the industrial chain is an effective way for the sustainable development of emerging industries. Samsung and LG are the two companies that have integrated the most outstanding industrial chain. In 2008, the four panel companies of Chi Mei, AUO, Innolux, and Hua Ying lost a total of US$2.5 billion, which is more than double the total loss of Samsung and LG. The advantages brought by Samsung and LG's industrial chain integration are vividly reflected, and this trend continues in South Korea's leading companies. Although China's flat-panel display industry is in its early stages of development, CEC has already completed the control of TPV Technology, the world's largest display and third-largest LCD TV manufacturer. Now, the completion of two panel production lines by China Panda will make the industry chain complete. Open up, among them in 60 inches, 65 inches and 70 inches and so on the oversized panel field TPV will also obtain the stable panel supply, this is the main purpose that CEC opens up the liquid crystal industry chain. In fact, the backbone enterprises of Panda TV and Great Wall Computer and other CEC can provide reliable downstream industries. It is necessary to pay attention to whether CEC and Chinese Panda can establish a complete upstream industrial chain like Korean companies such as Samsung.

Learn from the leap-forward development experience China's liquidity in the LCD panel, tax concessions, etc., and South Korea and other developed countries there is a certain gap, still need to be further strengthened.

After the outbreak of the Asian financial crisis in 1997, the global panel market has also fallen into a sluggish state. Although Japanese manufacturers occupy an absolute monopoly, most of them face the disadvantage of losing money. Under such circumstances, Samsung Electronics and LG once again adopted a counter-cyclical investment strategy, decisively invested billions of dollars, and built a large-size LCD panel production line. Such a high investment intensity has caused Japanese companies to fail. The ferocious expansion of Korean companies has changed the game rules of the TFT-LCD industry. Japanese people once questioned this type of investment behavior, but afterwards, it was the first time that the construction of the 5th-generation line was the watershed for Korea over Japan. It is even more ironic that the protagonist of the TFT LCD panel's eventual entry into the television application stage has been replaced by South Korea instead of Japan, the industry pioneer.

History began in an alarming similarity. In the face of the economic downturn, China's flat panel display industry's contrarian investment not only caught the 8.5th generation of BOE and Huaxing Optoelectronics to catch up with the production levels in South Korea and China Taiwan. On behalf of the line is blown up beyond the horn. Whether it can repeat the success of Samsung and LG requires the wisdom and courage of Chinese companies, but also the support of the government.

In the development of the flat panel display industry in South Korea and China, the government has invested heavily and introduced a large number of policies to support industrial development. China has also introduced a number of support policies for flat panel displays. The import tariffs on LCD panels have been raised since April 1, 2012. This has directly boosted the demand for foreign brands and domestic flat panel TV manufacturers to purchase home-made panels. Local governments have also vigorously Supports the development of the flat panel display industry. For the Chinese Pandas, the 10th-generation line is a major breakthrough for Nanjing’s “China LCD Valley†program, which is a reliable guarantee for the rapid development of the industry. However, it should not be overlooked that our country still has a certain gap with South Korea and other developed countries and regions in terms of financial support, tax incentives, etc., and it needs further strengthening.

The competitiveness of the mainland has significantly improved the rapid rise of China's panel industry, making the transition of the flat panel display industry to mainland China an inevitable trend.

The launch of the 10th generation LCD panel production line of the Chinese panda will greatly enhance the status of the flat panel display industry in mainland China. In 2011, with the production of high-end panel production lines such as BOE, China Star Optoelectronics, and China National Electric Panda, the domestically produced large-size panels had a qualitative breakthrough, but the global market share of domestically-made panels did not exceed 3%, while South Korea rose to approximately 53%. With the mass production of high-generation line in mainland China, the global market share of domestic panel is expected to exceed 20% in 2012. If the next 10th-generation line can be successfully completed, the Chinese mainland will grasp the new pattern of the flat panel display industry. Foreign companies have reduced the investment in LCD panel production lines, and the rapid rise of China's flat panel display industry has made the transition of the flat panel display industry to mainland China an inevitable trend. Just as in the 1980s, Xianyang Rainbow, Beijing Panasonic, and Shanghai Yongxin played a role in the development of China's color picture tube industry.

In addition, China's investment in 10 generation LCD panel lines will significantly increase the competitiveness of domestic LCD monitors. Domestic notebook computers, microcomputers, and color TVs have always maintained rapid growth. In 2011, China’s output of color TVs exceeded 120 million units, of which the output of LCD TVs exceeded 100 million units. At present, in the panel supply of major domestic branded LCD TVs, domestically produced panels accounted for only 6.8%, and Korea’s two major panel makers accounted for approximately 43.5%. LCD panels account for 2/3 of the total cost of LCD TVs, and domestic color TV manufacturers are forced to spend huge sums of money to import key components such as LCD panels. In 2010, for example, China imported more than 46 billion U.S. dollars worth of LCD panels, second only to integrated circuits, oil, and iron ore. In 2011, China's color TVs used liquid crystal panels to achieve everything from scratch, and completely ended the history of large-size LCD screens completely dependent on imports. If the 10th generation line is completed, it will provide 60-inch panels for domestic TV sets, which will further reduce the cost of domestic TV sets and increase market competitiveness.

Occupy a new height in the vertical integration of the industrial chain. The completion of the investment of the two panel production lines by the Panda in China will enable the industrial chain to be completely opened up, and TPV will also obtain a stable panel supply.

Vertical integration of the industrial chain is an effective way for the sustainable development of emerging industries. Samsung and LG are the two companies that have integrated the most outstanding industrial chain. In 2008, the four panel companies of Chi Mei, AUO, Innolux, and Hua Ying lost a total of US$2.5 billion, which is more than double the total loss of Samsung and LG. The advantages brought by Samsung and LG's industrial chain integration are vividly reflected, and this trend continues in South Korea's leading companies. Although China's flat-panel display industry is in its early stages of development, CEC has already completed the control of TPV Technology, the world's largest display and third-largest LCD TV manufacturer. Now, the completion of two panel production lines by China Panda will make the industry chain complete. Open up, among them in 60 inches, 65 inches and 70 inches and so on the oversized panel field TPV will also obtain the stable panel supply, this is the main purpose that CEC opens up the liquid crystal industry chain. In fact, the backbone enterprises of Panda TV and Great Wall Computer and other CEC can provide reliable downstream industries. It is necessary to pay attention to whether CEC and Chinese Panda can establish a complete upstream industrial chain like Korean companies such as Samsung.

Learn from the leap-forward development experience China's liquidity in the LCD panel, tax concessions, etc., and South Korea and other developed countries there is a certain gap, still need to be further strengthened.

After the outbreak of the Asian financial crisis in 1997, the global panel market has also fallen into a sluggish state. Although Japanese manufacturers occupy an absolute monopoly, most of them face the disadvantage of losing money. Under such circumstances, Samsung Electronics and LG once again adopted a counter-cyclical investment strategy, decisively invested billions of dollars, and built a large-size LCD panel production line. Such a high investment intensity has caused Japanese companies to fail. The ferocious expansion of Korean companies has changed the game rules of the TFT-LCD industry. Japanese people once questioned this type of investment behavior, but afterwards, it was the first time that the construction of the 5th-generation line was the watershed for Korea over Japan. It is even more ironic that the protagonist of the TFT LCD panel's eventual entry into the television application stage has been replaced by South Korea instead of Japan, the industry pioneer.

History began in an alarming similarity. In the face of the economic downturn, China's flat panel display industry's contrarian investment not only caught the 8.5th generation of BOE and Huaxing Optoelectronics to catch up with the production levels in South Korea and China Taiwan. On behalf of the line is blown up beyond the horn. Whether it can repeat the success of Samsung and LG requires the wisdom and courage of Chinese companies, but also the support of the government.

In the development of the flat panel display industry in South Korea and China, the government has invested heavily and introduced a large number of policies to support industrial development. China has also introduced a number of support policies for flat panel displays. The import tariffs on LCD panels have been raised since April 1, 2012. This has directly boosted the demand for foreign brands and domestic flat panel TV manufacturers to purchase home-made panels. Local governments have also vigorously Supports the development of the flat panel display industry. For the Chinese Pandas, the 10th-generation line is a major breakthrough for Nanjing’s “China LCD Valley†program, which is a reliable guarantee for the rapid development of the industry. However, it should not be overlooked that our country still has a certain gap with South Korea and other developed countries and regions in terms of financial support, tax incentives, etc., and it needs further strengthening.

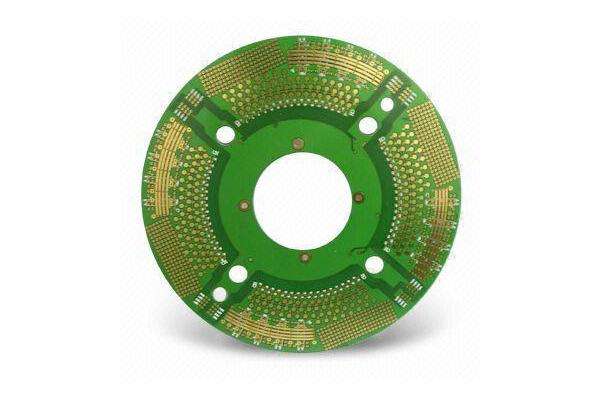

28-layer Multilayer PCB board, Base Material: FR4 TG 180. inner/outer copper thickness 1 oz. Immersion Gold surface treatment with green color soldermask. White color Legend.board thickness 3.6 mm. Min.line width/Min.line spacing 0.18/0.18 mm. E-test: 100%

Most of multilayer PCB boards are designed with impedance. There are two impedance tester in our factory.General single end impedance at 50 ohm, differential 100 ohm. Tolerance 10%.

Multilayer PCB

Multilayer PCB,Electronics Multilayer PCB,Custom-Made Multilayer PCB,Custom Multilayer PCB

Orilind Limited Company , https://www.orilind.com