In the first half of 2018, the overall market for kitchen appliances did not continue the strong momentum of the past few years. The volume and volume of multi-category retail sales declined in different degrees, but the declines mostly came from offline channels, online market, and various categories of kitchen appliances. The volume and volume of retail sales still increased substantially. In the first half of 2018, the retail sales of kitchen wires reached 17.35 billion yuan, a year-on-year increase of 27.6%.

At present, the Chinese kitchen appliance market is dominated by new demand and is heavily influenced by the real estate industry. Since last year, restrictions on purchases have been introduced throughout the country. The effect of macroeconomic regulation and control has gradually emerged in the first half of this year. The amount of housing and the supply of upstream supplies have been decreasing. For kitchen appliances that are more dependent on decoration, such as micro-steamed, embedded kitchen appliances, water heaters. The impact is obvious. Emerging kitchen appliances, including dishwashers and integrated stoves, are currently in low market penetration, but have great potential and will provide growth drivers for the overall kitchen appliance market.

From the perspective of segmentation, the scale of various products has increased significantly year on year. The online retail sales of range hoods was 4.06 billion yuan, up 12.8% year-on-year; the retail sales of gas stoves on the online market was 2.09 billion yuan, up 10.2% year-on-year; the retail sales of water heaters online market was 6.69 billion yuan, up 28.7% year-on-year. The market size of other market segments, including disinfection cabinets, dishwashers, microwave ovens, and embedded appliances, has significantly expanded compared with previous years. Online retail sales reached 4.01 billion yuan, a year-on-year increase of 40.7%.

The structure of the hood product tends to be stable

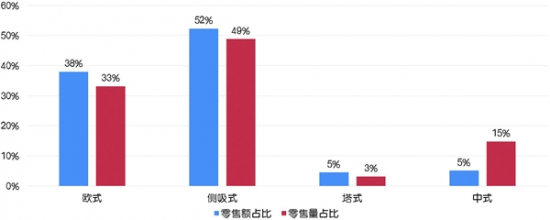

The proportion of different types of retail and retail sales of online range hoods in the first half of 2018

In the first half of 2018, the average price of products in the online range hood market increased by 2.4% year-on-year. This shows that after experiencing rapid development in recent years, the structure of online range hood products has stabilized, and the high, medium and low end products account for an average. In the first half of 2018, the market for European-style products, tower hoods and side suction products in the range hood market accounted for more than 90%, accounting for almost all of the market share of the range hood. The Chinese hoods generally accounted for a small proportion and have gradually withdrawn from the mainstream. Product ranks.

In the first half of 2018, the US hood delivered a bright-sounding answer and became the champion of online hood sales with 21% of retail sales. In recent years, Midea has provided a strong driving force for its kitchen and electric business through the opening up of R&D, technology, talents and mechanisms. Midea's kitchen power focused on the range hood technology, through the in-depth investigation of the user, the new self-cleaning function - the intelligent steam washing technology of the United States was brought to the range hood machine, which opened the era of self-cleaning of the hood. Full focus on the market segment and continuous upgrading of products, making the US kitchen appliances are building a new runway under the consumption upgrade.

In the first half of 2018, through the "French team won the championship, Vantage retired the full amount", Vantage earned the eye of the industry and became one of the best marketing cases in the first half of the year. In addition to the marketing level, Vantage has also produced outstanding results on many product lines, ranking first in the kitchen power sector. Vantage focuses on hood products, and its Mirror V2 hood uses intelligent voice control technology to bring more convenient experiences to consumers. It can automatically sense the temperature difference of the soot by the smart suction function, lock the air volume and capture the soot. As a benchmark for smart kitchen appliances, Vantage has always improved user experience as the original intention of product design. In the context of the maturity of AI and other technologies, Vantage is bound to deepen the industry and promote the intelligent development of kitchen appliances, bringing more users. A good product to solve the actual pain points.

In the first half of 2018, in the face of the “sudden growth†of competitors, Fang Tai’s online sales performance was not satisfactory. In the first half of 2018, the retail and retail sales of the Fangtai online range hood market were 20% and 13% respectively, and the gap compared with the first place was being widened. In the field of disinfection cabinets and embedded kitchen appliances, Fangtai has a clear gap with the first group of brands, and the retail sales of the two accounts for only 4% and 3%. In the dishwasher, Fang Tai is the main sink dishwasher, but because the sink dishwasher accounts for the small size of the overall market, coupled with the strong squeeze of the US, Siemens and other brands, the retail market share of Fangtai dishwasher Only 5%.

In the first half of 2018, online sales of hoods continued to gather in mid- to high-end products. 3001~4000 yuan became the highest price segment of retail sales, with the market share reaching 27.6%, which increased by 58.3%, second only to the price segment above 5,000 yuan. The total retail sales of the three price segments of 1001 to 1500 yuan, 1501 to 2,000 yuan, and 2001 to 3000 yuan accounted for more than 50% of the total retail sales, and the proportion of retail sales was also close to 70%, which became the "market responsibility" for online cigarettes. For the price segment products of 0-500 yuan and 501-1000 yuan, the proportion of retail sales is 0.4% and 7.3% respectively. It can be seen that under the current consumption upgrade trend, the low-end products with relatively simple functions and general performance are gradually losing. Initiative. Although the proportion of retail sales in the price range of 4,000 to 5,000 yuan was only 6.7%, the growth rate was 22.1%, showing strong growth potential.

Gas stove online market has increased steadily

In the first half of 2018, the market for gas stoves increased steadily. According to different types of stoves, the proportion of retail sales of natural gas products is close to 80%, making it the first choice for online consumers. In addition, the retail sales of liquefied petroleum gas products accounted for 21%. Under the trend of urbanization, the demand for liquefied petroleum gas products is declining year by year. From the perspective of brand structure, domestic brands have almost divided the online market. Among the top 10 online retailers and top brands, no foreign brands are on the list, and in the ranking of domestic brands’ retail sales, the gap between them is also It is not obvious. This is due to the close relationship between the brand and the channel of the smoke stove. The focus of each brand channel is different, and each has its own advantages and disadvantages, which makes the sales of its products close.

The average price of water heaters ushered in a small increase

In the first half of 2018, the water heater online market grew at a higher rate, and the average price of water heaters also ushered in a small increase. The retail sales of electric water heaters is almost the same as the retail sales of gas water heaters, but the retail volume of gas water heaters accounts for less than 40%, which indicates that with the addition of a series of new technologies and new functions, the gas water heaters with lower original prices are also Gradually develop to the high end. From the perspective of brands, the market share of domestic brands accounts for nearly 80%, and Midea, Haier and Wanhe are still the best among domestic brands.

In the first half of 2018, Midea's water heaters (including electric water heaters and gas water heaters) won the entire network sales champion. Its explosion-proof product F60-15WB5 (Y) electric water heater is the main "fast heating, enjoy a good bath", customized for urban fast-paced life. The product uses a "dive-down" long heating tube, which increases the contact area between the heating tube and the water, and the thermal efficiency is significantly improved. At the same time, the "water cyclone" water intake system can effectively guide the cold water entering the liner to ensure the hot water output rate. In the first half of 2018, among the top 10 electric water heater products in terms of retail volume and retail sales, there were 3 and 4 products in the US respectively. In the gas water heater products, there are also 3 products selected by Midea.

In the first half of 2018, Haier Water Heater made a good feedback from the market by continuously inspecting the needs of consumers for product adjustment and new product layout, so that the product quality is more in line with consumer demand. The jt3 series of explosive products with a price above 2000 yuan has entered the top ten online sales. The product has dual 3000W high power, fast heat and time saving, improved thermal efficiency and multiple security guarantees to meet the needs of consumers for water heater safety, rapid heat, intelligence, constant temperature and energy saving.

In the first half of 2018, Wanhe, as a domestic professional water heater manufacturer, also achieved excellent results, and the sales of electric water heaters and gas water heaters went hand in hand. While the Wanhe gas water heater maintains the first group in the industry, the electric water heater has also achieved great growth. Its explosion product JSQ24-12ET11 is mainly equipped with intelligent frequency conversion thermostat, adopting 4D constant temperature technology, no need for additional operation, automatic adjustment of hot water output according to demand, and can keep water temperature constant, comfortable and energy saving. The built-in variable frequency energy-saving fan can change the air content by adjusting the speed of the motor to stabilize the heat released by the combustion. Wanhe has 4 products to enter the top 10 retail sales of online gas water heaters in 2017.

Dishwasher competition is more intense

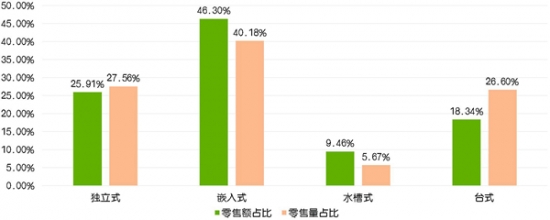

The proportion of different types of retail and retail sales of online dishwashers in the first half of 2018

In 2017, the growth rate of the dishwasher online market slowed down. After the rapid development in recent years and the addition of many new brands, the dishwasher market will usher in more intense market competition. From the price segment, dishwashers with a price below 3,500 yuan accounted for the largest online market retail volume, accounting for nearly 50%; 3,500 yuan to 4,299 yuan were also popular with consumers, with a market share of 33.16%. Secondly, the product is 4300 yuan to 5399 yuan, with a market share of 11.84%. Overall, the current price segment below 5,400 yuan accounts for over 90% of the retail market share of the dishwasher market. In terms of product types, the retail sales of embedded dishwashers continued to rise, accounting for nearly 50%; the retail sales of stand-alone and desktop dishwashers were 25.9% and 18.34% respectively. The retail sales of sink products accounted for only 9.46%. After several years of product changes and user education, the market share of sink products was still low. In terms of the proportion of retail sales, the stand-alone and desktop dishwashers accounted for nearly 60%, which stems from the fact that these two types of dishwashers do not require the kitchen to reserve the decoration position in advance, and the flexibility is stronger; The proportion is 40.18%, and the growth rate is the highest in the whole category of dishwashers, reaching 194.38%. This is because the embedded dishwasher can be perfectly integrated into the kitchen environment, saving space, and as the major manufacturers begin to pay more attention to after-sales service, Providing a more user-friendly home installation, and indirectly making the sales of embedded dishwashers climb.

Jiuyang, which is mainly engaged in small kitchen appliances such as soya-bean milk machine, has also begun to lay out the dishwasher product line in recent years. However, the current dishwasher brand pattern is relatively stable, and the head enterprise market share accounts for nearly 80%. The market space reserved for the new brand is already very small. This requires the company to differentiate the “combination box†based on the close to the consumer demand. Gradually get a place. At present, Jiuyang has introduced X5, X6 and other dishwasher products, the overall appearance, function, performance is more general, there is no bright spot in the intelligent, high-end, design and other aspects, the development of the Jiuyang dishwasher market is not optimistic.

Microwave ovens are gradually being marginalized

In the first half of 2018, the average price of the microwave oven online market was slightly increased, but the overall scale is still limited. With the emergence of submerged products such as steaming machine, embedded oven and embedded steamer, the market positioning of microwave ovens is gradually becoming more and more. Be marginalized. In terms of brand distribution, the market share of the two brands of Midea and Galanz totaled more than 90%, becoming the first group in the online market. In addition, the top 10 products in the online market and the top 10 products were also divided by the two brands. . Although they belong to the first group, the market share gap between Galanz and Midea is being widened year by year. In the first half of 2018, the volume of retail sales of Midea and Galanz was 59.74% and 36.73%, respectively, and the proportion of retail sales was 58.40% and 36.45% respectively. In the mature microwave oven market, such a big gap is difficult to catch up with. In recent years, Galanz has rushed into a number of product lines such as air conditioners and washing machines with the aim of “price butcherâ€. It hopes to use low-priced products supplemented by Internet marketing strategies to compete for the market, but in terms of current development, it is impacted on multiple product lines. Under unfavorable circumstances, its main microwave oven product line has also appeared weak, and the development prospects are not optimistic.

IH rice cooker online market growth rate is fast

As a must-have household appliance for Chinese people, rice cookers have been welcoming technology and functional innovations in recent years. At present, the online market "IH rice cooker" maintains a high growth rate of more than 70%, and is rapidly squeezing the market space of the traditional "heating rice cooker". As the “big head†of the home appliance industry, Gree’s Dasong brand has laid out the IH rice cooker product line earlier. Dong Mingzhu also personally worked for the Dasong IH rice cooker platform to promote the development of the domestic IH rice cooker. At the beginning of R&D, Gree set up a research and development team for IH rice cookers. According to the different types and origins of rice, a lot of experiments were carried out on the indicators of temperature, pressure, viscosity and heat. After the products went on the market, they were widely praised by the market. Dasong IH rice cooker has a full range of three-dimensional heating technology. The heat can quickly penetrate the rice core, quickly heat up and boil, and realize the full roll of rice. Its various intelligent control modes also give consumers more cooking choices.

24V 100AH Powerwall Solar Battery

Shenzhen Jiesai Electric Co.,Ltd , https://www.gootuenergy.com